Timeless Principles, Continual Learning

{ Euclidean Q1 2015 Letter }

We are excited about the state of Euclidean as we move into the middle of 2015. Our investment process is refined, our investor base is strong, and our understanding of market cycles is such that we are optimistic about the future.

We have implemented the portfolio management changes we described at year-end such that we hold a more balanced collection of inexpensive companies possessing good intrinsic qualities. Moreover, we have poured our energies into learning from the past seven years, expanding our machine learning tools, and refining how Euclidean evaluates investment opportunities.

Learning and Our Investment Process

One of Euclidean’s core values is a dedication to constant learning. We founded Euclidean with the belief that by learning from large bodies of experience and creating methods of systematically adhering to history’s lessons, there is an opportunity to deliver superior results. This process of looking for new answers and embedding new findings into our process never ends.

With machine learning, our focus has been to emulate how a great investor accumulates experience by observing how investments perform over time. We believe a significant advantage is that machine learning allows us to inform the learning process with vastly more examples than any one investor could experience on his own. It also enables us to discover real meaning hidden within the randomness that permeates market history, and that often plays upon investors’ well-documented tendencies to overweight recent information, seek confirmation of prior views, and overplay market cycles.

The passage of time and the evolution of our machine learning tools have enabled our investment operations to be informed by more market history. Moreover, our observations from seven years of overseeing our systematic process have equipped us to explore old questions in new ways. Because of our efforts, we believe our investment process has become progressively more robust.

The result of this work is in the details. At a high-level, the elements of our systematic approach remain the same. That is, we continue to seek companies that are inexpensive in relation to prior earnings, with consistent operating histories, strong long-term returns on capital, and balance sheets equipped to weather difficult periods. Looking across many thousands of investment outcomes in our machine learning research, these concepts collectively characterize what we have found to be the highest-batting-average types of equity investments. Our work has simply been to deepen our understanding of how these concepts are best expressed in companies’ operating histories, and to evolve the portfolio management rules whereby we put them into practice.

The most evident evolution has been our decision to hold more positions and take tax-neutral or tax-advantaged actions that lead to a more balanced allocation of capital across our portfolio. That is, from a universe of approximately 3,000 companies, we now seek to invest in approximately 50 that favorably align with our views regarding the trade-off between what you pay (price) and what you get (value) [1]. We also capitalize on opportunities to harvest short-term losses or realize long-term gains to more equally weight capital across positions. We made these decisions because we saw in our research that, across long-periods, results were generally enhanced by managing exposure to individual outcomes and allowing the good odds we believe come with buying good companies at low prices to play out with satisfactory consistency.

Investment Expectations

The great work we do is possible because we have earned the right to have you as investors. Over time, we have learned a lot about what makes an investor compatible with Euclidean, as well as the importance of having an investor base that understands our investment process and is aligned with our expectations.

Our singular focus is to deliver the strong long-term results you expect from Euclidean. Along the way, as we pursue these results, we expect to have returns that deviate from the broad market indices. After all, one cannot aspire to beat the market by owning the entire market. We differ decidedly from the market in seeking to purchase shares only in companies that are offered at very low prices in relation to their intrinsic characteristics. In fact, of our universe of potential investments, we invest only in the 1–2% that best match our criteria. This small slice of opportunity, reflecting good companies offered at attractive prices, is created when investor concerns and associated price volatility emerge for a company or industry sector.

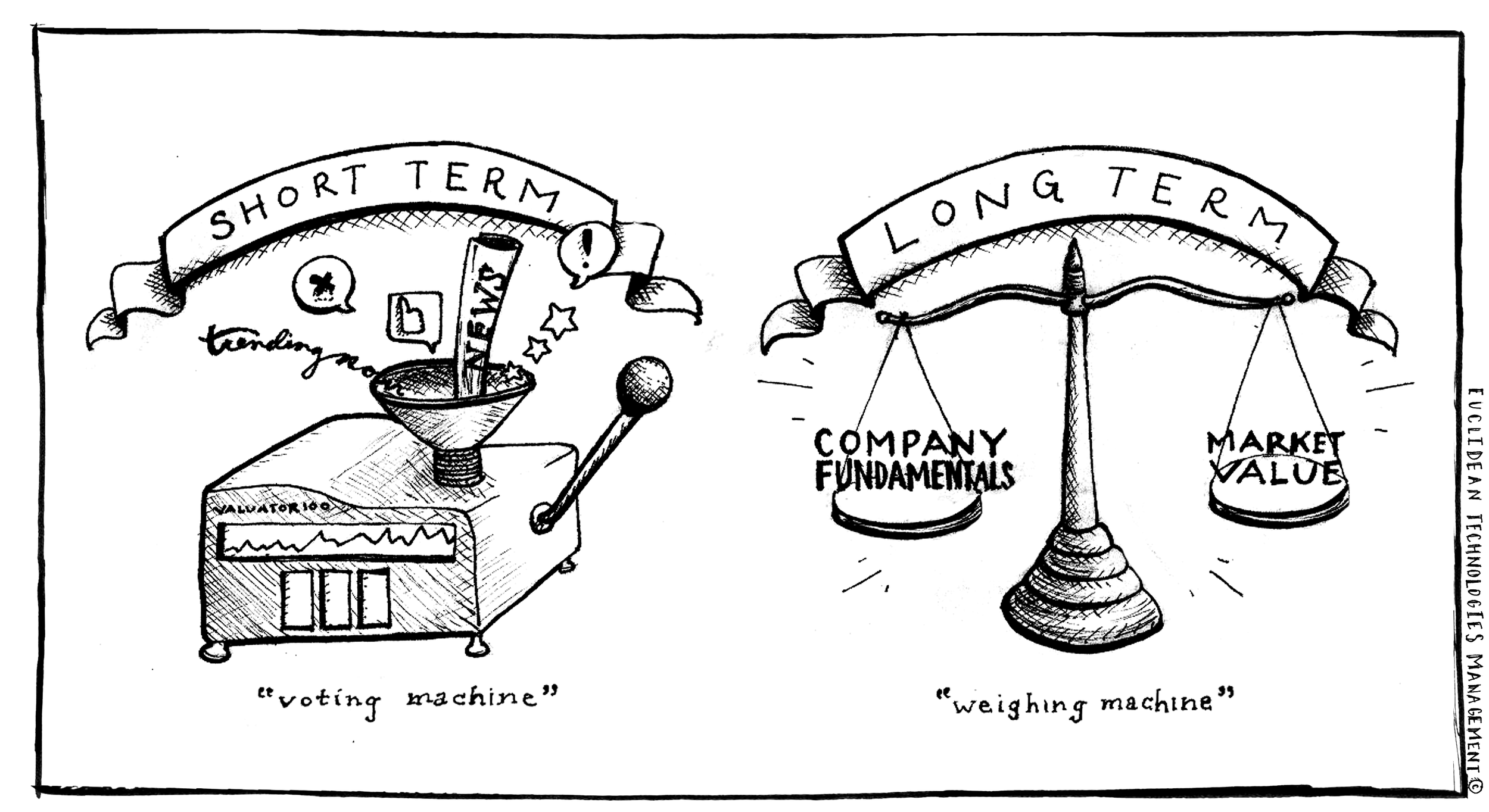

Because of this, one might say we accept short-term volatility as a symptom of our investing in companies during peaks of pessimism. But, that would be an incomplete summary of our view. We view price volatility not as a benign symptom but as an invaluable prerequisite for good investment opportunities to emerge. The inherent worth of a company does not fluctuate nearly as rapidly as public equity prices might lead one to think. Our research into the history of public equities leads us to unabashedly embrace Benjamin Graham’s teachings.

We see clearly that, in the short-term, the market is driven by sentiment and behaves as a voting machine. But, over the long-haul, the market works as a weighing machine and appropriately values companies based on their operating results. Our strategy is geared toward capitalizing on the divergence of these two mechanisms of the market.

Along the way, as we execute our strategy, luck plays a role and different market environments will cycle in and out of existence. The implication is that even with a sound investment strategy, just as with a professional baseball player who bats .300, there will be periods when you can look better and worse than you actually are. Because we believe the odds are on our side, however, we devote ourselves fully to our investment process and disregard short-term outcomes.

The alternative to adhering to a sound process and holding a long-term view can be seen everywhere in the investment landscape. Investors repeatedly over-respond to short-term developments, and they pile into and move away from investments at the wrong times. Because we believe our approach has a high-probability of long-term success, we will not allow short-term developments to distract us and we will endeavor to keep you from being distracted as well.

We emphasize this point, as it is not easy for most people to commit to value investment strategies across long periods (see this Jason Zweig WSJ article). The simulation and charts here provide a dramatic view into why this is true.

In this analysis [2], the simulated value strategy is simply to buy top decile of companies that are least expensive in relation to their prior year’s EBIT (earnings before interest and tax).

The top chart plots the simulated performance of this simple approach to value investing in context of the S&P 500’s total return. The bottom chart shows how much and for how long this value strategy would have fallen behind the S&P 500 at each point in time.

Across this particular simulation, over the period January 1973 to June 2014, the value approach shows a compound annualized return of 17.2% while the S&P 500’s total return (price change plus dividends) was 10.3%. Sounds amazing!

However, as the bottom chart shows, an investor using this value strategy would have had to endure 14 years (1988 through 2001) during which he would not have received much feedback that he was on the right path. Soon after recovering from falling behind the market by 30% from 1988–1991, he would have lagged by nearly 50% across a grueling six years.

Euclidean adheres to a different – but philosophically similar – approach, but also one that is materially more concentrated than the simulated strategy modeled here. As a result, this effect may be even more pronounced in Euclidean’s returns. So, what are the takeaways?

1 ) Even with a sound approach to equity investing, you should expect multi-year periods that do not provide much feedback that you are on the right path.

2 ) To succeed over the long-term, you should expect, and have enough conviction to withstand, these periods.

3 ) The rewards can be great for investors who have this kind of conviction.

*****

We greatly value the privilege of managing a portion of your assets and want you to be an informed Euclidean Investor. We are available to discuss the content shared here, individual positions in our portfolio, or any questions you might have. Please call us at any time. We enjoy hearing from you.

Best Regards,

John & Mike