The Current Market Cycle, and a Valuation Metric Showdown

{ Euclidean Q2 2017 Letter }

Euclidean uses machine learning to find persistent relationships between company fundamentals and investment outcomes. Through this effort, we have become convinced of the merits of maintaining a long-term commitment to buying good companies at low prices. Indeed, there is abundant evidence from a variety of sources indicating that a fruitful, long-term strategy would be to buy companies that were priced very low in relation to their fundamental qualities, such as their earnings or book values. Moreover, our own research suggests that this has particularly been the case for companies that also have a combination of consistent operations, good returns on capital, and balance sheet strength.

However, the discipline of owning inexpensive companies has delivered muted performance during recent years. Indeed, despite some reversion in 2016, the first half of 2017 has extended the longest period of expensive-stock dominance since World War II. In the past, investor enthusiasm for expensive companies generally has proven to be both cyclical and not a fruitful basis for long-term investing. As we review in this letter, after periods when expensive companies led the market, value investors historically have achieved strong returns.

In the pages that follow, we:

1. Revisit perspectives we shared 18 months ago regarding the history of value and growth cycles.

2. Provide simulations of different value factors’ relative merits in evaluating public companies and constructing portfolios of inexpensive stocks.

Update on the Current Growth vs. Value Market Cycle

In this section, we update an analysis that we first shared 18 months ago that reflects one of the most widely researched approaches to value investing, in which a value stock is defined as having high book equity to market equity.

In this analysis, it should be no surprise to see that the first half of 2017 has extended the current period of expensive-stock dominance. Investors have great enthusiasm for fast-growing FANG stocks and heightened awareness of incredible changes they are thrusting upon the distribution, retail, and media industries (among others).

Amid this enthusiasm, it is crucial to remember that in the past, investors have frequently taken even the best ideas to extremes, operating as though no price is too high for innovative companies driving the future. Likewise, investors often have extrapolated that new advances will make currently profitable and established companies irrelevant, as though there is no price low enough to consider owning shares in such legacy companies.

“Among large-cap stocks, the spread between value and growth is now larger than at any point over the past six decades, with one exception—the top of the dot-com bubble.” Barrons, June 28, 2017

Repeatedly, this dynamic has ended with investors reminded that even the best companies can become bad investments when priced too high, and that valuable opportunities to buy cash-generating companies at very low prices often emerge when outside catalysts spark the flames of fear. These reminders – lurking now, and perhaps ready to ambush investors once again – characterize what repeatedly has occurred across market cycles. You can see this in the graph below.

This graph [1] shows the cycles involved in buying out-of-favor, inexpensive (VALUE) companies vs. expensive (GROWTH) companies. In this graph, the blue line falls below the dotted line when the trailing five-year annualized return has been higher for expensive stocks than inexpensive ones, and goes above the dotted line when value stocks have outperformed. So, to glimpse the long-term advantage that value stocks have held, note that returns spend most of their time above the line. Value has outperformed growth across a significant majority of rolling five-year periods.

However, since 1945, there have been six distinct times when expensive stocks outperformed, based on trailing five-year compounded returns. The beginning of each of these periods is reflected by the green dots on the chart above. We are currently in one of these periods, with the prior one occurring during the dot-com era. This next chart provides a perspective on what has occurred following prior periods when expensive companies led the market.

After the previous five periods when growth outperformed value, value delivered very strong results over the subsequent five-plus years. In the current cycle, despite some head fakes in 2013 and 2016, the value rebound consistently observed in the past has not yet occurred.

Using Simulations to Compare Valuation Measures for Selecting Inexpensive Companies

The analysis above uses the valuation metric of book-to-market to classify companies into growth and value categories. This metric was popularized by Eugene Fama and Kenneth French in their paper, “The Cross-Section of Expected Stock Returns,” published in the Journal of Finance in 1992. While this use of book-to-market as a value factor permeates academic literature and is also at the core of how many value-oriented indexes are constructed, many value investors embrace different concepts when valuing companies.

For example, it is common practice to look at a business’s value from the perspective of a whole owner, for whom a company’s market capitalization provides an incomplete starting point. The concept of enterprise value is more encompassing, as it quantifies what it would take to purchase a company outright. It does this by reflecting not only the company’s market capitalization, but also the company’s cash that could be used to offset the purchase and the company’s debts, pension liabilities, and other interests that would need to be settled to wholly own the business.

Another difference is that value investors seek to understand the intrinsic value of a business, which is generally viewed as the discounted future cash flows that the business will provide to its owners. The challenge, of course, is that these future cash flows are unknown and can only be estimated. Well, a company’s book value provides very little information that can help us estimate a company’s future cash flows. Book value makes no distinction between a pile of cash and a company with productive assets, great products, and loyal customers. Many investors, therefore, look at other fundamental qualities to better approximate a company’s future ability to distribute cash to its owners.

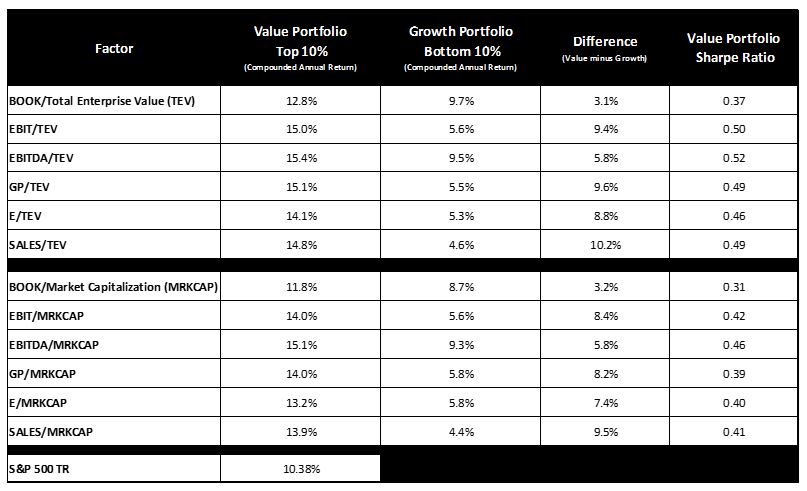

Given all of this, we thought we would share some simple simulations that look at which valuation metrics worked best for ranking investment opportunities during the period from January 1970 through March 2017. The results, shown below, reflect the average return from 300 simulations, each constructed with random starting conditions. The simulations use a consistent set of assumptions that, while more fully listed in the appendix, reflect:

A fund with $100 million in assets-under-management (held constant in 2010 dollars).

Investing in the 10% cheapest or 10% most expensive companies, as ranked by each metric, and holding each position for one year.

An investment universe of all NYSE-, NASDAQ-, and AMEX-listed companies with minimum market capitalizations of $400 million (also in 2010 dollars).

Various trading assumptions, including per-share trading costs and frictional costs that scale up when purchasing shares in companies with limited volume.

Here are the results. The top half shows various factors constructed using companies’ total enterprise values, whereas the bottom half uses companies’ market capitalizations.

See Appendix for Factor Definitions and Simulation Assumptions.

Past performance is not indicative of future results. Please see important disclosures at the end of this document.

We make the following observations:

1. Owning shares of inexpensive companies, regardless of definition, has been far more fruitful than owning expensive companies over the long term. Indeed, a good route to realizing above-average returns appears to have been adhering to a process — even a very simple one — for buying companies at low prices in relation to their sales, book values, or earnings.

2. Book-to-market appears to be the least-effective stand-alone measure. This makes sense, as the other measures reveal more about the operations of a company and may therefore provide a better valuation starting point.

3. It appears more fruitful to look at companies in the context of their total enterprise values, as opposed to their market capitalizations. Again, this resonates. To understand whether a company’s shares are mispriced from the perspective of a whole owner, it is crucial to understand first what it would take to own the company outright.

Simulations such as these can provide a directional sense of how a strategy might have done in the past. They provide a good way to compare different ideas using consistent sets of assumptions. However, to be clear, simulations do not tell you what the future will bring. Nothing can tell you what the future will bring.

At any given time, the approach that works best depends on the circumstances of the day. There have been and will be multi-year periods when valuation multiples expand, and growth stocks are in favor. However, the current environment has not been the norm.

While owning the most-expensive stocks would have served one well in recent years, doing so would have resulted in poor long-term performance. As demonstrated earlier, after all five prior growth-dominant periods observed during the past 50 years, value strategies rebounded with strong-enough returns to outperform when measured across entire market cycles.

Thus, we pursue attractive results by adhering to a philosophy that we believe has demonstrated favorable odds over the long term. We seek to profit when other investors’ actions cause good companies to be offered at great prices, and we believe that our investors will benefit as we do so in the years ahead.

Best regards,

John & Mike

The opinions expressed herein are those of Euclidean Technologies Management, LLC (“Euclidean”) and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Euclidean reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

Euclidean Technologies Management, LLC is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Euclidean including our investment strategies, fees and objectives can be found in our ADV Part 2, which is available upon request.

[1] Historical results represented herein are for illustrative purposes only and are not based on actual performance results. The hypothetical portfolio and the associated returns do not reflect the effect of transaction costs, bid/ask spreads, slippage, or management fees. Historical results are not indicative of future performance.

All results and the analysis described in the above post exclusively used data obtained from Kenneth R. French’s research data library. To construct the hypothetical set of returns herein, we used the data file available here. This dataset contains the returns of 25 portfolios, which are constructed annually at the end of June and represent the intersections of five portfolios formed on size (market equity, ME) and five portfolios formed on the ratio of book equity to market equity (BE/ME).

In our analysis, we constructed a hypothetical portfolio (the value vs. growth portfolio) that goes up when value stocks outperform growth stocks and goes down when growth stocks outperform value stocks. We calculated the monthly returns for the value vs. growth portfolio to be equal to the average of the five high BE/ME portfolios minus the average of the five low BE/ME portfolios in the dataset referenced above. All returns in our analysis are compounded monthly.

Appendix: Simulation Assumptions

In the simulation, Standard & Poor’s COMPUSTAT database was used as a source for all information about companies and securities for the entire simulated time period. The S&P 500 return is the total return of the S&P 500, which refers to the Standard & Poor's 500 Index, with dividends reinvested. Simulated returns also include the reinvestment of all income. Non-U.S.-based companies, companies in the financial sector, and companies with a market capitalization that, when adjusted by the S&P 500 Index Price to January 2010, is less than $400 million dollars were excluded from the ranking.

The simulation results reflect assets-under-management at the start of each month that, when adjusted by the S&P 500 Index Price to January 2010, are equal to $100 million. Portfolios were constructed by investing equal amounts of capital in the top decile of companies represented by various factors, then rebalancing monthly to equally weight the evolving constituents of the top decile. The number of shares of a security bought or sold in a month was limited to no more than 10% of the monthly volume for a security. During the period from 1983 to the present, the purchase and sale price of a security was based on the volume-weighted, daily closing price of the security during the first 10 trading days of each month. Prior to 1983, when daily pricing was not available for all securities, the purchase and sale prices of a security were based on the monthly closing price of the security. Transaction costs are factored in as $0.01 per share, plus an additional slippage factor that increases as a square of the simulation’s volume participation in a security. Specifically, if participating at the maximum 10% of monthly volume, the simulation buys at 1% more than the average market price or, conversely, sells at 1% less than the average market price. Other than these transaction costs, the simulated results do not reflect the deduction of any management fees or expenses. Historical simulated results presented herein are for illustrative purposes only and are not based on actual performance results. Historical simulated results are not indicative of future performance.

Factor Definitions

Market Capitalization (MRKCAP): Common Shares Outstanding x Price Per Share

Total Enterprise Value (TEV): Market Capitalization + Preferred Stock + Minority Interest + Total Debt - Cash and Cash Equivalents

Earnings Before Interest and Taxes (EBIT): Operating Income Before Interest and Taxes + Non-Operating Income

Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA): Operating Income Before Interest, Taxes, Depreciation, and Amortization + Non-Operating Income

Gross Profit: (GP): Revenue – Cost of Goods Sold

Net-Income (E): Net Income Available to Common and Before Extraordinary Items

Sales (SALES): Revenue

Euclidean Fund I, LP Performance

Look Through Financials, as of Quarter End

These aggregated portfolio metrics reflect our systematic process for buying shares in historically sound companies when their earnings are on sale.

--

Ten Largest Holdings, as of Quarter End

This information provides a sense of Euclidean's current portfolio and the individual positions provide a means of better understanding how our investment process seeks value.

--

net performance, fund lifetime

This section summarizes the investment results of Euclidean Fund I, LP since its fund inception in August 2008.